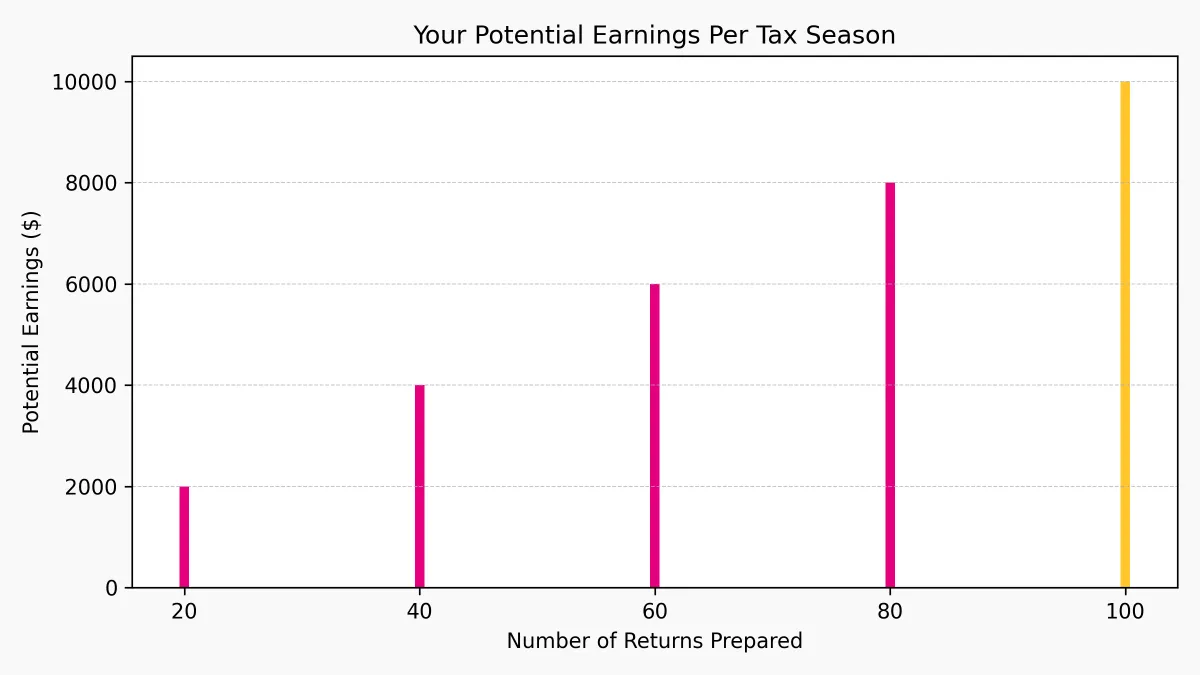

Earn $2,000–$10,000+ This Tax Season –

No Experience Needed

Become a certified tax preparer with step-by-step training and guided mentorship—launch your own flexible, high-income business in just weeks.

Ready to earn flexible income on your terms?

Our step-by-step program teaches you to prepare returns, serve clients, and launch a profitable tax business—no experience required.

Limited seats available!

INTRODUCING

Refund2Income: Your Path to Becoming a Boss-Level Tax Expert

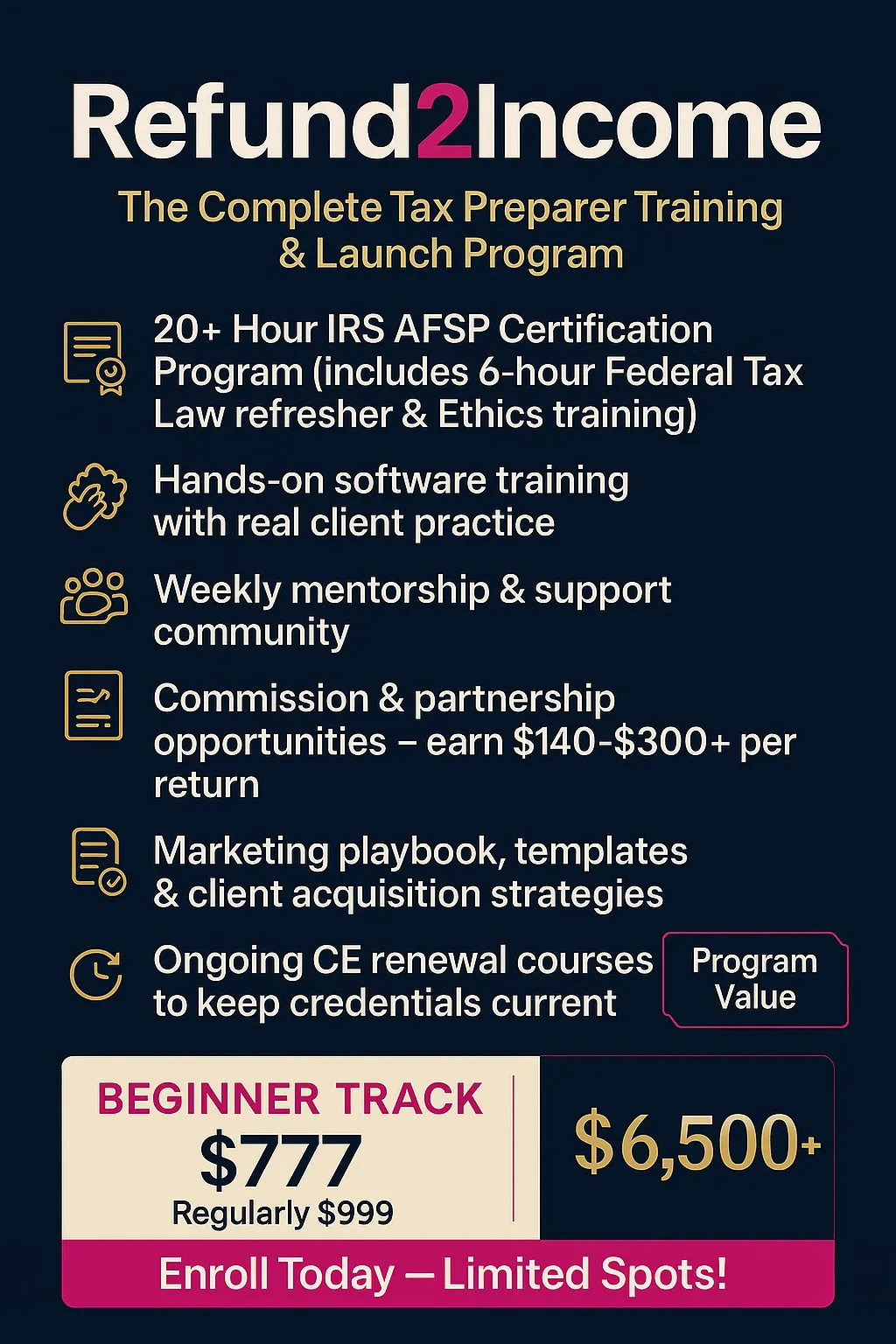

Beginner Track

PIF Discount!!

$599

(Afterpay/Klarna Available)

Full IRS AFSP Certification Path (20+ hours)

Hands-on software training

Real-client practice & mentorship

Commission & partnership options – 40–50% commission for beginners; 50–60% for returning preparers

Complete support & resources

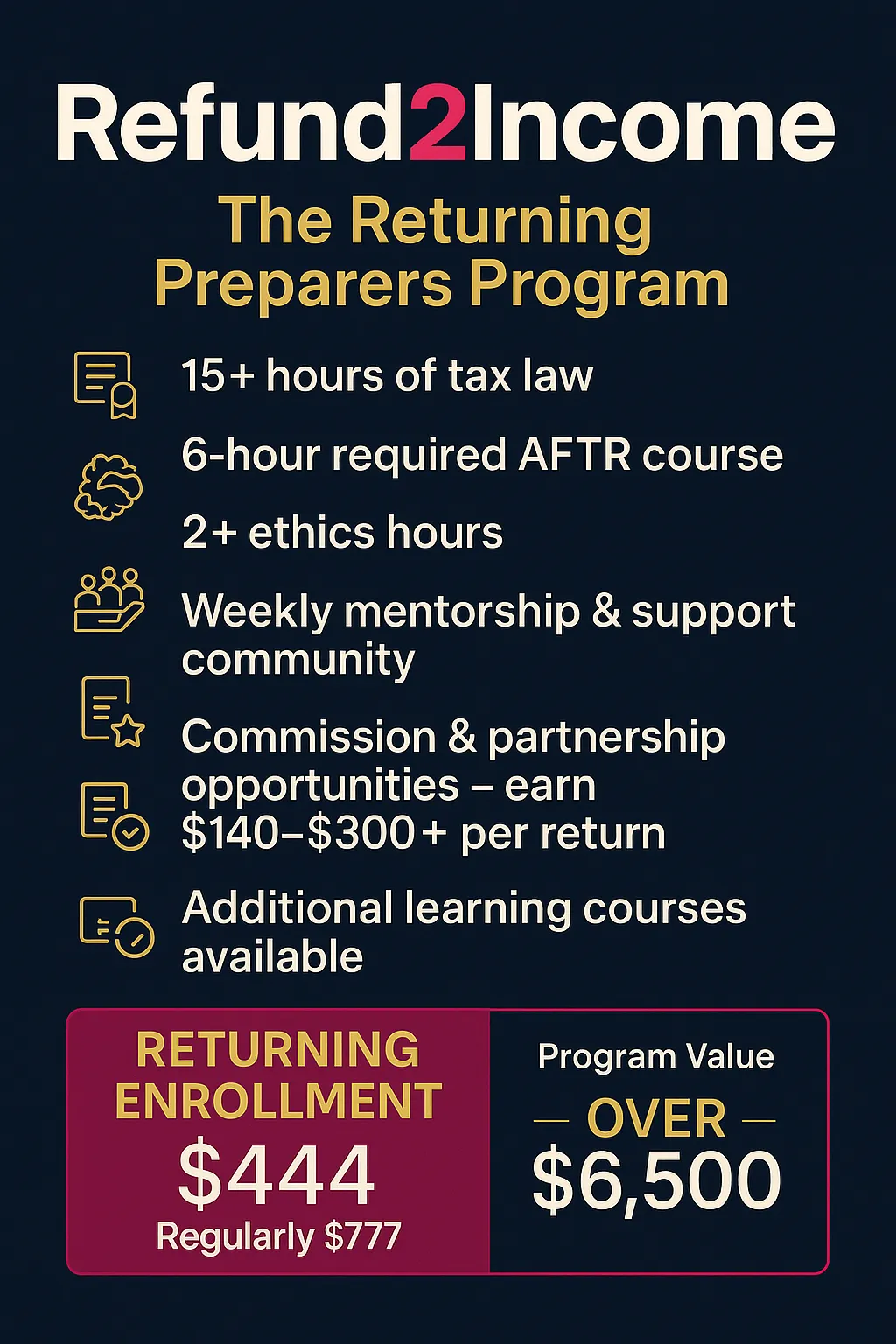

Returning Track

15-hour CE renewal + 6-hour AFSP

Advanced income-boosting add-ons

Access to resource library & updates

Partner & earn 50–60% commission per return

Must have at least 3 years experience

MEET your instructor & CEO

Melissa Griffin, EA

Melissa Griffin is an IRS Enrolled Agent and owner of HB Financial Group with more than 10 years of experience training and mentoring tax preparers.

As an IRS-approved Continuing Education provider, she’s helped hundreds of students turn tax knowledge into real income. Melissa created Refund2Income to give you the exact tools, training, and support to go from beginner to confident pro—with the potential to build a profitable tax business on your own terms.

With her step-by-step guidance, you’ll not only learn the tax laws, but also how to turn tax season into your opportunity season.

Who's This Perfect For

Stay-at-home parents ready to create flexible income

College students looking for a profitable side hustle

Professionals wanting to add an additional income stream

Individuals ready to start their own tax preparation business

Anyone eager to learn a high-demand, recession-proof skill

Anyone

LOOKING TO GET INTO THE TAX WORLD BUT NOT BE ALONE

Results & Testimonials

Jasmine earned $3,200 in her first 3 weeks!!

Hundreds of preparers have generated thousands in extra income.

Our top students make $140–$300+ per return through our commission program.

Join the success stories — YOU could be next!

Real results: Our community of tax preparers consistently earns between $2,000–$10,000+ each season. With our support and proven system, you can create life-changing income and freedom for your family.

Individual results may vary based on effort and client base.

F.A.Q'S

Do I need prior tax experience?

No — our program teaches everything from scratch through the 20+ hour AFSP certification curriculum, so you can start preparing taxes with zero prior experience.

Who is this program for?

This program is for motivated individuals (18 years or older) looking to earn extra income while learning the in-demand skill of tax preparation. It’s a great fit for:

People who want flexible, part-time work

Stay-at-home parents

College students

Anyone wanting to work from home — even late at night

People interested in tax laws and helping others

You’ll need to be willing to market yourself to grow your client base. If that’s something you’re excited to do, this program can fit beautifully into your life — especially if you need work that’s flexible, family-friendly, and easy to fit around other commitments.

What support will I receive?

Support includes weekly Q&A sessions to get your questions answered, direct email access to our mentors, a private community of tax preparers, return reviews during tax season to ensure accuracy, and ongoing education resources—plus our marketing playbook to help you build your business. We provide professional tax software, bank products (including refund advances), client incentives like travel vouchers, office space, and a comprehensive marketing playbook with ongoing support.

What are the requirements for earning the AFSP certification?

- Complete 18 hours of IRS‑approved continuing education: 10 hours federal tax law, 2 hours ethics, and a 6‑hour Annual Federal Tax Refresher (AFTR) course.

- Pass the AFTR final exam: 100 questions, with a passing score of 70% or higher. You have three attempts to pass.

- Gain practical skills beyond the minimum: Our program delivers 20+ hours of training, including hands‑on tax software practice and mentorship.

- Maintain a valid PTIN: You must hold a current Preparer Tax Identification Number and agree to abide by IRS Circular 230.

- Finish by December 31, 2025: IRS continuing education requirements must be completed by year‑end to qualify for the upcoming filing season.

IRS AFSP Program Overview: https://www.irs.gov/tax-professionals/annual-filing-season-program

- IRS Circular 230: https://www.irs.gov/pub/irs-utl/pcir230.pdf

How long does the certification program take?

Our program is self‑paced, but we recommend completing the required 18 hours of IRS‑approved CE and training within a 12‑week schedule to stay on track.

What score do I need to pass the final exam?

You must score 70% or higher on the AFTR exam, and you have three attempts to pass.

What equipment do I need?

You'll need a computer with a numeric keypad, reliable high‑speed internet, and up‑to‑date antivirus protection.

How is my data protected?

All preparers must sign and follow our Written Information Security Plan (WISP) and use secure connections and virus protection.

Your Success is Backed by Knoxville’s #1 Tax Team

Voted Best Tax Preparation Company – Knoxville Community Votes

Voted Best Bookkeeping Company – Knoxville Community Votes

Hundreds of 5-Star Google Reviews

Official IRS Approved CE Provider

Decades of combined tax industry experience

Ready to Start Earning with Refund2Income?

Get certified, gain clients, and start earning within weeks with Refund2Income – the fast track to your own tax business.

Choose Your Plan

BEGINNER TRACK

$777 or $250/mo

Comprehensive AFSP certification & 20+ hours of training

Real tax software & client practice from day one

CE credits included & ongoing mentorship

Revenue share & marketing tools to maximize earnings

RETURNING TRACK

$444 early bird or $777 regular

15-hour renewal course + AFTR requirement

Access to software updates & resource library

Income-boosting add-ons & marketing upgrades

Optional Office Owner track & leadership training

IRS CE & AFSP Certification Requirements

Complete your CE and final exam by Dec 31, 2025 to earn your AFSP certificate.

Helpful Resources

- IRS AFSP Program Overview: https://www.irs.gov/tax-professionals/annual-filing-season-program

- IRS Circular 230: https://www.irs.gov/pub/irs-utl/pcir230.pdf

- Course syllabus and AFTR outline available upon request.